If you want to know how to manage collections effectively and improve the flow of money in your company, keep reading. For businesses, having ample cash flow is an integral part of their overall operations. This is especially true for companies that rely on customer payments to stay afloat.

By charging customers on a regular basis, businesses can ensure they have the necessary funds to cover expenses and continue operating. However, not all companies are able to do this effectively.

Many companies struggle with delinquent customers and do not know what to do with them; worse, the accounts continue to accumulate, and the companies lose liquidity.

Liquidity is key to a company’s survival and often its worst enemy.

When customers stop paying their bills on time, this can lead to missed opportunities and decreased profits. Banks are reluctant to lend money to companies that have high levels of delinquent debt, so these companies often find themselves in a bind.

Listen to what your customer

When a client fails to pay his debts, it can be challenging to determine the root of the problem. However, in order to start negotiations and find possible solutions, it is essential to understand what the problem is.

This can be difficult, as many debt problems are personal in nature and do not lend themselves to easy explanation. However, by listening to the client and taking into account his specific situation, creditors may be able to help solve the issue.

People often overlook the importance of listening when it comes to building a strong relationships with others.

You can create a more meaningful connection and build trust by paying attention to what the client is saying and letting them express themselves. Clients will feel appreciated and understood, which in turn will lead to positive changes in their behavior.

Send a payment reminder

Some customers skip payments because they don’t remember that they have outstanding debts or forget the payment’s due date, so send reminders to keep the customer on top of their payments.

In some cases, customers might not even be aware that they have a debt that needs to be paid. When this happens, it can lead to missed payments and a snowball effect where more and more money is owed.

Make the payment terms clear

When it comes to paying bills, most of us are familiar with the concept of due dates and deadlines. However, there are often other terms and conditions that need to be clarified, such as what is considered a late payment?

What are the consequences for not following through with a payment? In order to ensure that payments are made on time and without any difficulties, you must make sure your client understands what they are responsible for and what could happen if they do not comply.

Your website and collection emails must include information about the payment terms and the consequences of not complying with the agreement.

This will help ensure that your clients understand what they are agreeing to and help them make informed decisions about their payment. Including this information will also help you keep track of payments and ensure that you comply with your agreements.

Do not resort to threats

If you are a business owner and your client does not pay you on time, it can be frustrating. However, it would be best if you did not let your emotions dominate you and resort to threats to recover the money. In most cases, these threats will not have good results. Instead, try to work out a payment plan with your client. If that fails, consider filing a lawsuit. But be sure to consult an attorney before doing anything.

Offer alternatives

When a client does not pay on time, you must offer them alternatives so that they can meet their debt. This could include accepting an item as collateral, creating payment plans or charging you by other means. If you cannot work with the client and they do not pay you on time, you may have to take legal action.

Leave the collection in professional hands

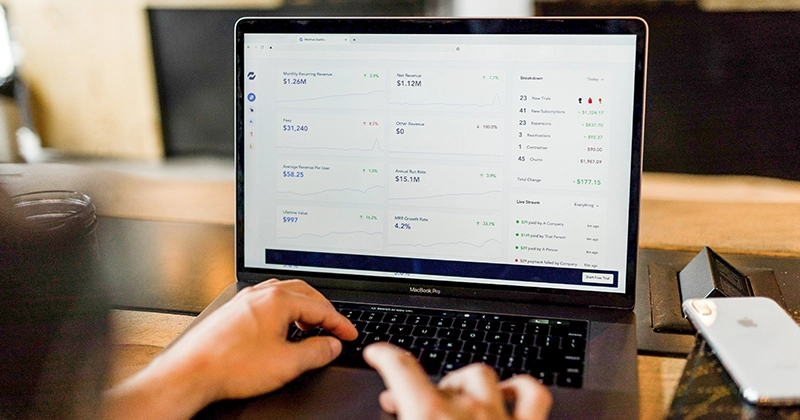

How to manage collections effectively

The process of collecting payments from clients can be a tedious and time-consuming task, which is why it is best to outsource this duty to an expert.

Those who are in charge of this process should have experience and knowledge of the industry, as well as the ability to strategy and plan efficiently. Hiring an expert can save you time and money.

When you are carrying out collection management, it is essential to have a strategic approach; by having someone in charge ensures that the process runs smoothly and that all payments are collected as soon as possible.

Collection management is an art and requires experience and strategy. A common mistake businesses make is relying on their own staff to collect payments, which can be difficult and time-consuming.

At Succor Center, we know how to handle all collection management for your company. Whether your business is small or large, we have the experience and knowledge to get the best results. We use a variety of techniques to get your money fast and efficiently, so you can keep your business running smoothly. Contact us today to learn more about our collection management services!